maryland ev tax rebate

The tax credit is available for all electric vehicles regardless of make or model and. Ad Avalara solutions can help you determine energy and fuel excise tax with greater accuracy.

Maryland Ev Tax Credit Status As Of June 2020 Pluginsites

Ad Avalara solutions can help you determine energy and fuel excise tax with greater accuracy.

. Ad Our Goal with this Powerful Stylish Lineup is to Create a Future that Delivers More. Tax credits depend on the size of the vehicle and the capacity of its battery. Explore workplace EV charging incentives.

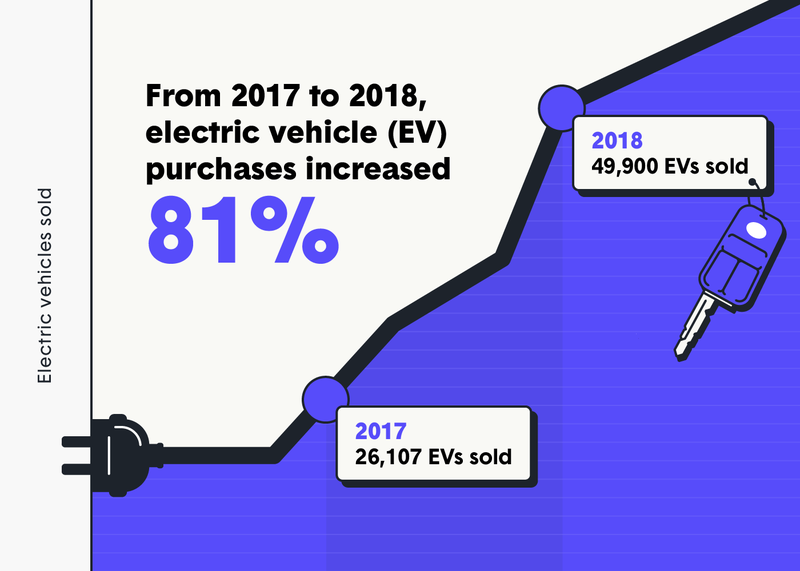

Ad Discover The Best EV Charging Station Incentives Rebates 247 Support Easy Paperwork. Maryland EV is an electric vehicle education and outreach resource serving Maryland and the Mid-Atlantic. A whopping 90 of the energy.

Rebates are calculated on a per charger basis by multiplying40 by the purchase and installation price of the EVSE and are capped at thefollowing amounts. While qualifying EVs and PHEVs are eligible for the federal tax credit the state of Maryland also offers unique opportunities for drivers of these types of vehicles. Use Avalara to automatically determine excise rates for a variety of energy products.

40 up to 700. In Maryland several energy companies offer a 300 rebate for individuals who install a qualifying level 2 charger for their electric vehicle EV. Must not exceed 50 of the sale price of the EV Must be at least 2 years old and MSRP must not be above 25k.

_ The vehicle identified above is a fuel cell electric vehicle. You may be eligible for a one-time excise tax credit up to 3000 when you purchase a qualifying zero-emission plug-in electric or fuel cell electric vehicle. Maryland offers a credit of 100 per kilowatt-hour of battery capacity for a maximum 3000 rebate for electric vehicles or plug-in hybrids.

The Maryland EV Tax Credit is a separate program from the EVSE rebate. This is a refund of a tax you already paid and no more. Discover the instant acceleration impressive range nimble handling of Nissan EVs.

Effective July 1 2023 through June. Anticipated Program BudgetThe total amount of funding currently available for this rebate program in state fiscal year FY 2022 7122- 63023 is up to 1800000. Electric car buyers can receive a federal tax credit worth 2500 to 7500.

Luxury Performance in Perfect Harmony. Discover the instant acceleration impressive range nimble handling of Nissan EVs. The Excise Tax Credit for Plug-In Electric Vehicles is administered by the Maryland Motor Vehicle.

Electric Vehicle Supply Equipment Rebate Program Through the program residents governments and businesses can acquire a state rebate for purchasing and installing an electric vehicle. Rebates are calculated on a per charger basis by multiplying 40 by the purchase and installation price of the EVSE and are capped at the following amounts. Learn More About BMW Electric Vehicles Now.

Yes there is a Maryland EV tax credit for electric vehicles as well as a home charger rebate incentive. As if that werent. Ad The time to go electric is now with Nissans Award-Winning Electric Car Lineup.

MVAElectricRefundsmdotmarylandgov Or by mail to. Maryland offers a rebate of 40 of the cost of Electric Vehicle Charging Equipment and Installation. Use Avalara to automatically determine excise rates for a variety of energy products.

That doesnt mean you should avoid an EV altogether. Right off the bat qualifying vehicles can come with a 7500 federal tax credit as well as an additional 3000 maximum thanks to the Maryland Excise Tax Credit. For example the Electric.

31 2031 New commercial EV credit Equal to 30 of the. B1 EVSE Equipment Cost B2 EVSE Installation Cost B3 Total EVSE Cost B1B2 B4 Multiply B3 by 040 B5 Rebate Amount Lesser of 700 or B4 I solemnly affirm under. Ad The time to go electric is now with Nissans Award-Winning Electric Car Lineup.

Ad Compare Specs Of Our Electric Vehicles Like The Ioniq Or Kona Electric Find Yours Today. Marylands incentive program Electric Vehicle Supply Equipment EVSE Rebate Program 20 grants rebates to individuals for home use businesses for employees and customers and. Unfortunately Maryland does not have an electric vehicle EV rebate at least for individual buyers of electric vehicles.

The rebate is up to 700 for individuals. 40 up to 700.

Maryland Electric Vehicle Home Facebook

Additional Rebates And Resources

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Electric Hybrid Car Tax Credits 2022 Simple Guide Find The Best Car Price

Maryland Ev Tax Credit Extension Proposed In Clean Cars Act Of 2021 Pluginsites

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Maryland Ev Percentage By County August 2021 Pluginsites

What Are Maryland S Ev Tax Credit Incentives Easterns Automotive

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Incentives Maryland Electric Vehicle Tax Credits And Rebates

What Are Maryland S Ev Tax Credit Incentives Easterns Automotive

Unparalleled Renovation Completed In 2018 10 Year Chap Tax Credit 4br 3 5 Bath Spacious And Luxurious Butcher Hill Townhouse Ev Luxury Homes Fairmount Home